Yormark Thinking Out-of-the-Box for a Big 12 Financial Advantage

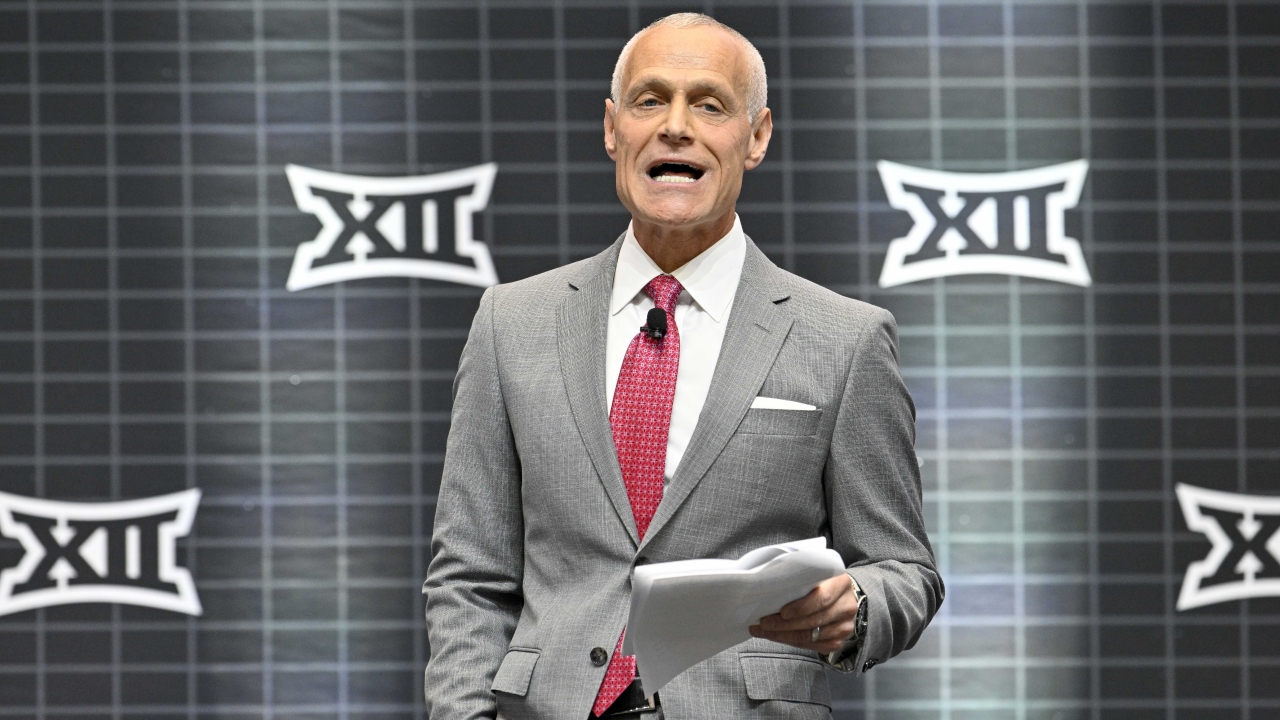

STILLWATER – What has been known to some in abstract fashion since the Big 12 head coaches meetings the first week of May and in a more precise form on May 29-30 at the Big 12 Conference President’s Spring Meetings is now out in the public. Big 12 Commissioner Brett Yormark has always promised his constituents that he would come up with solutions to the money crisis created by conference realignment and the television networks with their larger contracts for the Southeastern Conference and the Big Ten Conference. Since he came on board those two leagues have even demanded and received a larger share of the College Football Playoff revenue. Now on top of the revenue shortfall in the Power Four, the settlement of the House vs. NCAA and related class-action suits have all of the NCAA schools on the hook for a $280 billion settlement with the plaintiffs and a promise to share 20 percent, around $22 million annually with the current student-athletes.

The outgoing grows and the incoming may grow some with new television contracts, but the Big 12 has four new mouths to feed in Arizona, Arizona State, Colorado, and Utah with a 16-team conference. Now, we know one way Yormark may make up for the monetary issues for the league’s members. Yormark promised the coaches and athletic directors he was working on plans. He went further and got into details with the Presidents. The college athletics world is spinning with the news that Yormark is in negotiations with a monster private equity firm, Luxembourg-based CVC Capital Partners, for a potential cash influx of $800 million to $1 billion.

The news was first reported on Thursday morning, June 13 by Dennis Dodd of CBS Sports. Dennis is an old friend from Big 12 Skywriter days that has always been good at breaking stories in college athletics and especially in the Big Eight-to-Big 12.

A later report from The Athletic, part of the New York Times media family, stated the conference is talking about giving its’ naming rights to Allstate as part of a separate deal. The potential conference name is the Allstate 12 Conference, according to a person with knowledge of the discussions.

Overall, how does this work?

The negotiation is for that amount of cash influx in return for 15-to-20 percent ownership of the Big 12 Conference. What that entitles CVC and their partners to is negotiable. They have a huge stable of clients that could benefit from marketing and commercial opportunities with the Big 12. Could you see corporate logos, like Allstate, on stadium and arena signage; on playing fields, courts, and diamonds; and on jerseys and uniforms? The answer is absolutely yes. In fact, you could see multiple corporate logos. College sports is becoming a business, so to handle those business expenses like revenue sharing then the business needs more revenue.

As for the conference, a portion of the money would go directly to the 16 league members, and the partnership would give the conference access to CVC's investment services and clients. There is a fear from some old-times in college athletics, of which I certainly qualify, but I am not included. I see this as a viable way to keep up with the Jones (SEC and Big Ten). You have to be careful and have people knowledgeable in the negotiations, but Yormark isn’t new to this. He is experienced at the “art-of-the-deal”.

That money will be handy to offset the growing television revenue and CFP returns that are larger for the SEC and Big Ten. It will be very handy in using for the approximately $22 million annually that will be shared with student-athletes, likely most of it going to the revenue maker, football. That money is not considered academic, scholastic, so it is not subject to Title IX or other government mandates.

CVC is a global private equity monster that manages over $200 billion in investments worldwide, according to its website. CVC actually made a presentation to the school presidents of the Big 12 at the meetings in Dallas late May.

Dodd’s story had this sentence:

While one source described the talks as "pretty serious," many league presidents need further convincing. Persons who spoke with CBS Sports preferred to remain anonymous due to the sensitive nature of the discussions.

The same situation existed with me except my sources asked that I keep it totally off the record.

I can tell you that Oklahoma State University is well-versed in private equity and it’s workings with alum Carl D. Thoma. A co-founder of private equity firm Thoma Bravo with Orlando Bravo, Thoma is one of the deans of the buyout business. He has met with a number of Oklahoma State University individuals including school president Dr. Kayse Shrum and football head coach Mike Gundy.

There is nothing that says a school can’t negotiate to sell portions of or certain athletic programs to private equity. Again, understand it is all business now.

“It really comes down to how much money you have,” college football insider Brett McMurphy told me and the Triple Play Sports Radio audience in an interview. He’s right, and Brett Yormark is thinking of every potential exchange he can to keep his schools caught up.